What is Axis bank RTGS form?

Axis bank RTGS form (real-time gross settlement) is a form that helps to transfer money from one bank to another bank. It will be worked based on real-time settlements, without delay, and postpone the transfer of funds will be done at present movement. Axis bank RTGS payment method is a completely electronic payment gateway.

In axis bank RTGS have a chance to transfer funds from one to another in two different forms, one is online and offline. To transfer money thought online no need to go bank, if you want to transfer funds online (net banking option) then there is no need to go to the bank. In axis bank, RTGS users can transfer up to 2 lakhs without any issues, and there is no limitation on transformation. The axis bank RTGS/ NEFT transactions are the safest and secure payments.

The axis bank will be providing various services like RTGS, NEFT, and so on. NEFT (national electronic fund transfer) is also one of the most secure and safest methods of payment.

How to download the axis bank RTGS form

To fill the RTGS form need to download it and it is in the form of a pdf. In every bank, we can see both RTGS and NEFT s service, so there is a need to download the form which is help to enter details of yours like bank account number, name, and IFSC code, and so on. Here we mention a link that helps to find the axis bank RTGS and NEFT form. You can Download the axis bank RTGS and NEFT from pdf by copying the link which is mention in the below section,

Click Here to Download the most recent axis bank RTGS and NEFT forms in PDF format.

What are the timings of RTGS?

Based on weekends and weeks days the timing system will have differed. In an online system, customers can use and access it at any time, but offline methods have a schedule, based on schedule the transfer of funds will be depend

- From Monday to Friday the working hours will be 7:00 AM to 6:00 PM.

- On Saturday the working hours will be 7:00 AM to 6:00 PM, in second Saturdays there is no chance to transfer the fund from one bank to another bank

- On Sundays, it’s unable to transfer money at any cost.

Information will be included in the axis bank RTGS/NEFT form

-

- In RTGS/NEFT application form we can see two different sections; one is remitter details and another one is beneficiary details.

- In remitted details have to fill in the account number and remitted name.

- In beneficiary details section includes name, account number, bank IFSC code, the amount in words and figures, applicable charges.

- Enter mobile number and email ID.

- On the right side of the form need to include beneficiary and remitted and payment details.

- Need to enter date and branch.

- Have to include cheque leaf information.

Finally, after filling the entire information bank customers have to submit, it to a bank.

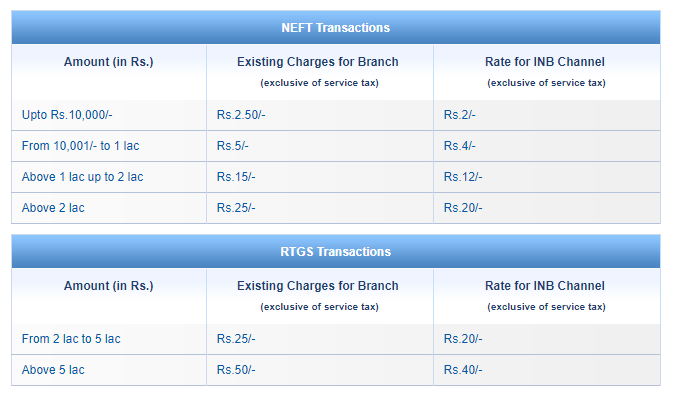

The charges of axis bank RTGS / NEFT is?

Axis bank is one of the biggest private banks which apply a limited charge while doing fund transactions; it will be the best service with averages charges. The charges will be applicable when a person transfers more than 2 lacks. The charges will be applicable for each transaction. If a person going to transfer Rs: 2 lakhs to Rs: 5 lack need to pay Rs. 25 for every transaction. When a person transfers more than Rs: 5 lakhs then need to pay Rs: 50 for every transaction.

The charges of axis bank NEFT is?

The charges will be applicable when a person transfers more than 10,000 rupees.

-

- When a person transfers 10,000 rupees then need to pay Rs: 2.50 per transaction.

- If a person transfers between 10000 + to Rs 100000 they have to pay Rs 5 for every transaction.

- When a customer transfer between Rs 1 lack to Rs 2 lacks they need to pay 15 rupees as a transaction charge.

- When there is a need to transfer more than 2 lakhs then need to pay 25 rupees for every single transaction.

Transferring funds through internet banking in axis bank RTGS

By following simple sets users can transfer funds in the internet banking system,

-

- By using account details create a name and password.

- Visit the axis banking website in the browser.

- Tap on the personal banking option.

- Select the fund transfer or payment link option.

- Then log in to your account by using password and login-id.

- Give your debit card no and enter the pin code.

- Tap on RTGS and enter the details of both beneficiary and remitted details.

- Enter the fund that you want to transfer to another account.

- Finally, by selecting submit option to complete the transaction process.

- https://www.axisbank.com/download-forms/accounts

- https://taxheal.com/wp-content/uploads/2018/06/Axis-Bank-rtgs-neft-application-form.pdf

Conclusion

Axis bank RTGS and NEFT are payment methods that help to transfer amounts of funds safely and securely. Selecting the RTGS system helps to transfer funds at a time without delay. This service is available in every branch of axis bank and customers can transfer money through online payment systems and offline payment systems.